New 2026 IRS Contribution Limits for Retirement Savings Accounts and What it Means for You

The IRS has announced higher contribution limits for retirement plans in 2026, giving you the chance to set aside more money in your tax-advantaged 401(k)s and IRAs. These increases happen each year to keep up with inflation, and they play an important role in helping people protect their savings from both rising prices and taxes.

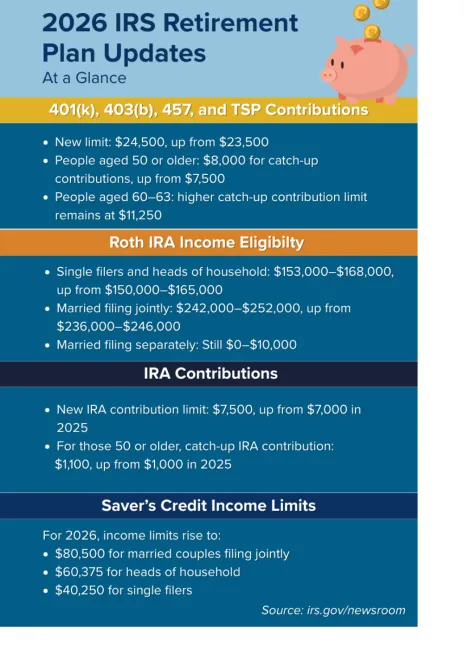

For 2026, several key limits are rising.

Higher 401(k), 403(b), 457, and TSP Contribution Limits

If you participate in a workplace retirement plan, like a 401(k), 403(b), government 457 plan, or the federal Thrift Savings Plan, your annual contribution limit will increase in 2026.

Roth IRA Income Eligibility Is Also Adjusting

A Roth IRA is a retirement account where you contribute money you’ve already paid taxes on, and then your investments can grow tax-free, with tax-free withdrawals in retirement. To contribute to a Roth IRA, your income must fall within certain ranges.

Updated Income Phase-Out Ranges for IRAs

You can usually deduct the money you put into a traditional IRA, but there are some rules. If you or your spouse is covered by a retirement plan at work, the amount you’re allowed to deduct may be reduced based on your income and how you file your taxes. In some cases, the deduction may be eliminated if your income is too high.

Saver’s Credit: Limits Are Increasing

The Saver’s Credit is a tax credit designed to help low- and moderate-income workers save for retirement.

The Impact for You

Retirement planning is personal and can change as you move through different phases of your life. These changes give you more room to save, whether you’re aiming to max out your accounts, catching up in your later working years or increasing your contributions a little each year.

If you’re thinking about increasing contributions, adjusting your retirement strategy, or just want help deciding what makes sense for your situation, please reach out.

District Financial Planning and LPL Financial do not provide legal advice or tax services. Please consult your legal advisor or tax advisor regarding your specific situation.

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results.

There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.